We’re going broke!

Or so the guys on Wall Street want you to think.

After all, they’re looking at the $2.6 trillion surplus in the Social Security Trust Fund and thinking how many billions they could take home by skimming just a little bit off the top of it if it were privatized.

And if they could get their hands on Medicare - which is even more money than Social Security and growing faster as the boomers age - then they could make hundreds of billions of dollars with Paul Ryan’s privatization plan.

So the politicians and the think tanks they help fund are hysterical.

Here’s an example from the Washington Post:

Senate Budget Committee Chairman [Republican] Pete Domenici warned the nation's governors the other day, "Medicare can be bankrupt in 2 1/2 years," unless some way is found to put the brakes on its burgeoning costs

Oops - that was from The Washington Post on March 6, 1983. How about this one from the New York Times...

The fund that pays all Government reimbursement for hospital care of Medicare patients is projected to become insolvent in the next decade or so.

That was from The New York Times on January 22, 1989.

In fact, there’s a long history of predicting Medicare is going to go broke any minute, and along with it Social Security.

You’ll see Republicans getting hysterical about it every place from Congress to Morning Joe - Medicare is going broke!

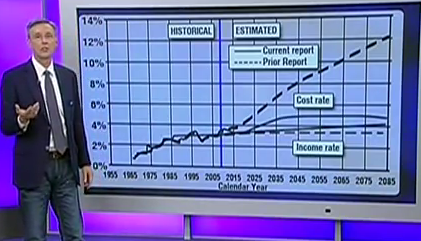

Right... And here’s a graphic from the Congressional Research Service that shows how, last year, the projections changed...

The dotted lines are the projected income and expenses when calculated in 2009 - you can see how bad things looked.

Then they recalculated things last year, and the solid lines are the new projections.

And you can see how the actual numbers in past years were always pretty close to each other - this is up to the projection point - it's pretty close, projections and actual costs, all the way back to 1964 when the fund was created.

But here are the projections that were made of when the fund would be exhausted starting in 1970 - it was projected in 1970 - 1971 actually - we’d be bankrupt by 1973.

| Year of Projected Insolvency of the Hospital Insurance Trust Fund in Past Trustees’ Reports | |

|---|---|

| Year of Trustee Report | Year of Insolvency |

| 1971 | 1973 |

| 1972 | 1976 |

| 1981 | 1991 |

| 1982 | 1987 |

I don’t remember that happening, do you? I mean, in '71 they said we’d be out of business by '73.

In 1972, the Nixon administration projected disaster by 1976.

In 1981, the Reagan administration said we’re going to be over the top in 1991, and the next year they even got it more dire - in 1982 they said Medicare was dead in '87.

I remember 1987- I don’t remember Medicare dying.

Every year of the Reagan-Bush 1980s, and the first couple of years of the 1990s, in fact, Medicare was predicted to croak within - at the most - fifteen years, and usually, like in 1984, that it would be in the sewer in six years.

There’s an old saying - "Figures don’t lie, but liars can figure".

That’s why the Republicans got Medicare Part D in there so that the government can’t negotiate wholesale drug prices - it’ll suck over $600 billion out of Medicare in the next decade and hand it all - all of it as in profit - over to a dozen or so big drug companies.

Medicare Part D was intended to be a poison pill, planned to kill off Medicare.

Want to save Medicare? Just change the law so they can negotiate fifty or sixty or eighty percent discounts on the billions of dollars worth of drugs that they buy every year - let them do exactly what the Veterans Administration and Wal-Mart and Walgreen’s pharmacies do and negotiate lower prices.

And what about the other big "entitlement" - Social Security?

Most likely you - like most other Americans - make less than $106,000 a year. Which means that every penny of income you get, you and your employer pay a Social Security tax on.

Even if you make only $4000 a year - so little money you pay no income taxes - you still pay Social Security and Medicare taxes - the green here is the Social Security.

Source: Nathan Newman

If you make $6100 a year - this is $4900 a year - if you make $6100 a year or $7800 a year like some Wal-Mart employees, look at all this Social Security tax that you're paying.

But did you know that if you earned more than $106,000 a year, the magic Republican Fairy Dust gets sprinkled on you, and after that first $106,000, you no longer have to pay Social Security taxes?

Not a penny!

So last year, when Phillipe Dauman, CEO of Viacom, took home $84.5 million, he got to take $84,394,000 of it totally free of any Social Security tax.

Not a penny.

Walt Disney’s Robert Eiger took $28 million in income, but only paid Social Security taxes on the first $106,000 - the next $27,894,000 that he took was tax-free, at least with regard to Social Security taxes.

This is what’s referred to as the "Social Security Cap".

Want to fix Social Security forever?

Source: Nathan Newman

Just do away with the cap - and then the millionaires and billionaires are paying the same rate as everybody. And when they pay the same percentage as you do, it'll start to work.

It’s really easy - except that if you even mention it to a Republican like Eric Cantor, Paul Ryan, or Mitch McConnell, they’ll walk out of the room.

Gotta protect those billionaires.

So let’s stop all the stupidity and the demagoguery and stop scaring average working people and make these relatively small changes - like letting Walt Disney’s CEO pay his fair share of Social Security taxes - that will solve our entitlement program shortfalls.

Pass it on!

That's The Big Picture.